Chapter 9: Risk Measurement II

Summary

1. An underlying contract is currently trading at a price of 75. If there are no interest considerations

(interest rates are zero), for each pair of options choose the correct answer.

a. If the underlying price changes, but all other market conditions remain unchanged, which option's price will change the most?

Ⅰ a 1-month 75 call, a 1-month 80 call Ⅱ a 1-month 75 put, a 1-month 80 put Ⅲ a 1-month 80 put, a 3-month 80 putAnswer: III, because those contracts are ITM and have the highest delta.

b. If the underlying price changes, but all other market conditions remain unchanged, which option's delta will change the most?

Ⅰ a 1-month 75 call, a 1-month 80 call Ⅱ a 1-month 75 call, a 3-month 75 call Ⅲ a 1-month 65 put, a 3-month 65 putAnswer: II, because the delta changes accordingly to the gamma and gamma is highest for ATM contracts.

c. If the implied volatility changes by the same amount for all options, but all other market conditions remain unchanged, which option's price will change the most?

Ⅰ a 3-month 70 put, a 3-month 75 put Ⅱ a 1-month 75 put, a 3-month 75 put Ⅲ a 1-month 85 call, a 3-month 85 callAnswer: II, because vega is the change in contract value with respect to implied volatility, and it is higest for ATM contracts.

d. If two weeks pass with no change in the price of the underlying contract, but all other market conditions remain unchanged, which option's price will change the most?

Ⅰ a 1-month 70 call, a 1-month 75 call Ⅱ a 1-month 75 call, a 3-month 75 call Ⅲ a 1-month 65 put, a 3-month 65 putAnswer: II, because theta ATM is largest.

e. If the underlying contract is stock, and interest rates change by the same amount for all expiration months, but all other market conditions remain unchanged, which option's price will change the most?

Ⅰ a 3-month 70 call, a 3-month 75 call Ⅱ a 1-month 80 call, a 3-month 80 call Ⅲ a 1-month 70 put, a 1-month 75 putAnswer: I, interest rates affect the time of expiration the most.

f. If the underlying contract is a stock that is expected to pay a dividend in two months, if the dividend is changed but all other market conditions remain unchanged, which option's price will change the most?

Ⅰ a 3-month 70 call, a 3-month 75 call Ⅱ a 1-month 80 call, a 3-month 80 call Ⅲ a 3-month 75 put, a 3-month 80 putAnswer: III, dividend affects delta the most because of the price change. And dividends cause the puts to be more ITM.

2. For each option below, with the given change in market conditions is each risk measure (delta, gamma, theta, vega),

in absolute value, getting bigger (+), smaller (-), or staying about the same (0)?

underlying price = 50

time to expiration = 3 months

interest rate = 0

a. The underlying price falls to 45.

\[

\begin{array}{|c|c||c|c|c|}

\hline

\text{} & \text{Delta} & \text{Gamma} & \text{Theta} & \text{Vega} \\

\hline

\text{40 call} & - & + & + & + \\

\hline

\hline

\text{50 call} & - & - & - & - \\

\hline

\hline

\text{60 call} & - & - & - & - \\

\hline

\hline

\text{40 put} & + & + & + & + \\

\hline

\hline

\text{50 put} & + & - & - & - \\

\hline

\hline

\text{60 put} & + & - & - & - \\

\hline

\end{array}

\]

b. The underlying price rises to 55.

\[

\begin{array}{|c|c||c|c|c|}

\hline

\text{} & \text{Delta} & \text{Gamma} & \text{Theta} & \text{Vega} \\

\hline

\text{40 call} & + & - & - & - \\

\hline

\hline

\text{50 call} & + & - & - & - \\

\hline

\hline

\text{60 call} & + & + & + & + \\

\hline

\hline

\text{40 put} & - & - & - & - \\

\hline

\hline

\text{50 put} & - & - & - & - \\

\hline

\hline

\text{60 put} & - & + & + & + \\

\hline

\end{array}

\]

c. Two weeks pass.

\[

\begin{array}{|c|c||c|c|c|}

\hline

\text{} & \text{Delta} & \text{Gamma} & \text{Theta} & \text{Vega} \\

\hline

\text{40 call} & + & - & - & - \\

\hline

\hline

\text{50 call} & 0 & + & + & - \\

\hline

\hline

\text{60 call} & - & - & - & - \\

\hline

\hline

\text{40 put} & - & - & - & - \\

\hline

\hline

\text{50 put} & 0 & + & + & - \\

\hline

\hline

\text{60 put} & + & - & - & - \\

\hline

\end{array}

\]

d. Volatility falls.

\[

\begin{array}{|c|c||c|c|c|}

\hline

\text{} & \text{Delta} & \text{Gamma} & \text{Theta} & \text{Vega} \\

\hline

\text{40 call} & + & - & - & - \\

\hline

\hline

\text{50 call} & 0 & + & - & 0 \\

\hline

\hline

\text{60 call} & - & - & - & - \\

\hline

\hline

\text{40 put} & - & - & - & - \\

\hline

\hline

\text{50 put} & 0 & + & - & 0 \\

\hline

\hline

\text{60 put} & + & - & - & - \\

\hline

\end{array}

\]

e. Volatility rises.

\[

\begin{array}{|c|c||c|c|c|}

\hline

\text{} & \text{Delta} & \text{Gamma} & \text{Theta} & \text{Vega} \\

\hline

\text{40 call} & - & + & + & + \\

\hline

\hline

\text{50 call} & 0 & - & + & 0 \\

\hline

\hline

\text{60 call} & + & + & + & + \\

\hline

\hline

\text{40 put} & + & + & + & + \\

\hline

\hline

\text{50 put} & 0 & - & + & 0 \\

\hline

\hline

\text{60 put} & - & + & + & + \\

\hline

\end{array}

\]

3.

Underlying stock price = 100

time to expiration = 3 months

interest rate = 6.00%

volatility = 20%

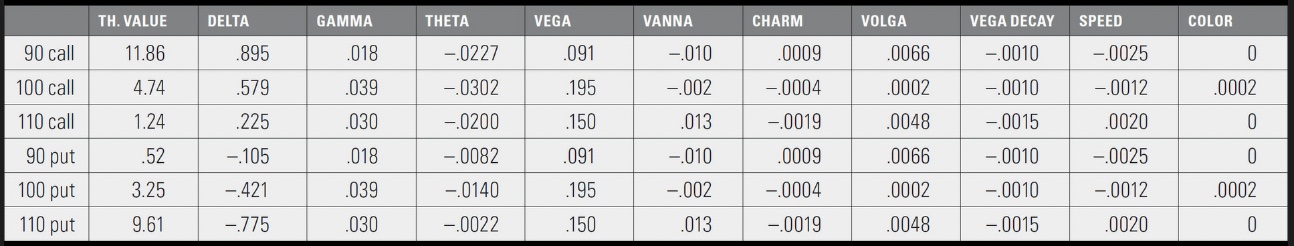

Using the table of values above, try to answer the following questions:

a. If volatility falls to 18%, what will be the new delta values of the 90 call and the 100 put?

$$ \text{90 Call} $$ $$ Vanna = \frac{\partial\Delta}{\partial\sigma} = -0.010 $$ $$ \Delta_{new} = \Delta_{old} - \Delta Vol \times \frac{\partial\Delta}{\partial\sigma} $$ $$ \Delta_{new} = 0.895 - 2 \times (-0.010) = 0.915 $$ $$ \\ $$ $$ \text{100 Put} $$ $$ \Delta_{new} = -0.417 $$ $$ \text{Note: When volatility decreases it causes delta to move away from 50/-50.} $$ b. If 10 days pass, what will be the new delta values of the 90 put and the 100 call?

$$ \text{90 Put} $$ $$ Charm = \frac{\partial\Delta}{\partial\Theta} = 0.0009 $$ $$ \Delta_{new} = \Delta_{old} + \Delta Time \times \frac{\partial\Delta}{\partial\Theta} = -0.096 $$ $$ \\ $$ $$ \text{100 Call} $$ $$ Charm = \frac{\partial\Delta}{\partial\Theta} = -0.0004 $$ $$ \Delta_{new} = \Delta_{old} + \Delta Time \times \frac{\partial\Delta}{\partial\Theta} = 0.575$$ $$ \text{Note: As time passes the OTM put becomes less likely to expire ITM causing} $$ $$ \text{decrease in magnitude of delta. The ATM Call gets closer to 50 or kind of stays the same.} $$ c. If 10 days pass, what will be the new gamma values of the 90 call and the 100 put? $$ \text{90 Call} $$ $$ color = \frac{\partial\Gamma}{\partial\Theta} = 0.0002$$ $$ \Gamma_{new} = \Gamma_{old} + \Delta Time \times \frac{\partial\Gamma}{\partial\Theta} = 0.018$$ $$ \\ $$ $$ \text{100 Put} $$ $$ color = \frac{\partial\Gamma}{\partial\Theta} = 0.0002$$ $$ \Gamma_{new} = \Gamma_{old} + \Delta Time \times \frac{\partial\Gamma}{\partial\Theta} = 0.041$$ d. If the underlying price falls to 96, what will be the new vega values of the 90 put and the 110 call? $$ \text{90 Put} $$ $$ Vanna = \frac{\partial Vega}{\partial S} = -0.010$$ $$ Vega_{new} = Vega_{old} + \Delta S \times \frac{\partial Vega}{\partial S} = 0.131 $$ $$ \\ $$ $$ \text{110 Call} $$ $$ Vanna = \frac{\partial Vega}{\partial S} = 0.013$$ $$ Vega_{new} = Vega_{old} + \Delta S \times \frac{\partial Vega}{\partial S} = 0.098 $$ e. If the underlying price rises to 103, what will be the new theta values of the 90 call and the 110 put? $$ \text{90 Call} $$ $$ Charm = \frac{\partial \Theta}{\partial S} = 0.0009$$ $$ \Theta_{new} = \Theta_{old} + \Delta S \times \frac{\partial \Theta}{\partial S} = -0.02 $$ $$ \\ $$ $$ \text{110 Put} $$ $$ Charm = \frac{\partial \Theta}{\partial S} = -0.0019$$ $$ \Theta_{new} = \Theta_{old} + \Delta S \times \frac{\partial \Theta}{\partial S} = -0.0079 $$ f. If ten days pass, what will be the new vega values of the 100 call and 110 put? $$ \text{100 Call} $$ $$ \text{Vega decay} = \frac{\partial Vega}{\partial\Theta} = -0.0010$$ $$ Vega_{new} = Vega_{old} + \Delta time \times \frac{\partial Vega}{\partial \Theta} = 0.185 $$ $$ \\ $$ $$ \text{110 Put} $$ $$ \text{Vega decay} = \frac{\partial Vega}{\partial\Theta} = -0.0015$$ $$ Vega_{new} = Vega_{old} + \Delta time \times \frac{\partial Vega}{\partial \Theta} = 0.135$$ g. If volatility rises to 25%, what will be the new vega values of the 90 put and the 110 call? $$ \text{90 Put} $$ $$ \text{Volga} = \frac{\partial Vega}{\partial\sigma} = 0.0066$$ $$ Vega_{new} = Vega_{old} + \Delta \sigma \times \frac{\partial Vega}{\partial \sigma} = 0.121 $$ $$ \\ $$ $$ \text{110 Call} $$ $$ \text{Volga} = \frac{\partial Vega}{\partial\sigma} = 0.0048$$ $$ Vega_{new} = Vega_{old} + \Delta \sigma \times \frac{\partial Vega}{\partial \sigma} = 0.174 $$

4. When a sensitivity changes for a given change in market conditions, we can approximate the impact

of that sensitivity by taking the average value of the sensitivity over the given change. (Recall that this was the method

used in question 4 of the Risk Meashurement section when estimating the effect of the delta and gamma together.)

a. If volatility rises to 25%, what will be the approximate theoretical values of the 90 put and 100 call?

$$ \text{90 Put} $$

$$ \text{Volga} = \frac{\partial Vega}{\partial\sigma} = 0.0066$$

$$ Vega_{i} = 0.091 $$

$$ \overline{Vega} = \frac{Vega_{i} + Vega_{f}}{2} $$

$$ Vega_{f} = Vega_{i} + \Delta\sigma \times \frac{\partial Vega}{\partial\sigma} = 0.124 $$

$$ TV_{f} = TV_{i} + \Delta\sigma \times \overline{Vega} = 1.0575 $$

$$ \\ $$

$$ \text{100 Call} $$

$$ \text{Volga} = \frac{\partial Vega}{\partial\sigma} = 0.0002$$

$$ Vega_{i} = 0.195 $$

$$ \overline{Vega} = \frac{Vega_{i} + Vega_{f}}{2} $$

$$ Vega_{f} = Vega_{i} + \Delta\sigma \times \frac{\partial Vega}{\partial\sigma} = 0.196 $$

$$ TV_{f} = TV_{i} + \Delta\sigma \times \overline{Vega} = 5.7175 $$

b. If the stock price rises to 107, what will be the new gamma values of the 100 call and 110 put?

$$ \text{100 Call} $$

$$ \text{Speed} = \frac{\partial \Gamma}{\partial S} = -0.0012 $$

$$ \Gamma_{i} = 0.039 $$

$$ \Gamma_{f} = \Gamma_{i} + \Delta S \times \frac{\partial \Gamma}{\partial S} = 0.0306 $$

$$ \\ $$

$$ \text{110 Put} $$

$$ \text{Speed} = \frac{\partial \Gamma}{\partial S} = 0.0020 $$

$$ \Gamma_{i} = 0.030 $$

$$ \Gamma_{f} = \Gamma_{i} + \Delta S \times \frac{\partial \Gamma}{\partial S} = 0.044 $$

c. If the stock price rises to 107, what will be the new delta values of the 100 call and the 110 put?

$$ \text{100 Call} $$

$$ \Delta_{i} = 0.579 $$

$$ \Gamma_{i} = 0.039 $$

$$ \Delta_{f} = \Delta_{i} + \Delta S \times \overline{\Gamma} = 0.8226 $$

$$ \\ $$

$$ \text{110 Put} $$

$$ \Delta_{i} = -0.775 $$

$$ \Gamma_{i} = 0.030 $$

$$ \Delta_{f} = \Delta_{i} + \Delta S \times \overline{\Gamma} = 0.8226 $$

$$ \text{Note: use the previous problems } \Gamma_{f} \text{ to calculate } \overline{\Gamma}. \Delta \text{ is calculated with averaging } \Gamma $$

d. Is the stock price rises to 107, what will be the approximate theoretical values of the 100 call and the 110 put?

$$ \text{100 Call} $$

$$ \Delta_{i} = 0.579 $$

$$ \Delta_{f} = 0.8226 $$

$$ \overline{\Delta} = 0.7008 $$

$$ TV_{f} = TV_{i} + \Delta S \times \overline{\Delta} = 9.65 $$

$$ \\ $$

$$ \text{110 Put} $$

$$ \Delta_{i} = -0.775 $$

$$ \Delta_{f} = -0.516 $$

$$ \overline{\Delta} = -0.6455$$

$$ TV_{f} = TV_{i} + \Delta S \times \overline{\Delta} = 5.09 $$

$$ \text{Note: The new theoretical value was calculated using the average delta as we know that delta is not constant }$$

$$ \text{as market conditions change. Averaging gets us a better approximation.} $$

5. An option's elasticity is defined as the percent change in the option's value for a one percent change in the price of the underlying contract. \[ \begin{array}{|c|c|c|c|} \hline \text{Call Value} & \text{Call Elasticity} & \text{Put Value} & \text{Put Elasticity}\\ \hline \text{6.84} & \text{5.25} & \text{2.30} & \text{-2.90}\\ \hline \end{array} \] a. If the price of the underlying is defined as the percent change in the option's value for a one percent change in the price of the underlying contract. $$ \lambda = \frac{\Delta V}{\Delta S} \text{ in terms of %} $$ $$ \Delta V = \lambda \times \Delta S $$ $$ V_{f} = V_{i} + V_{i} \times (\lambda \times \Delta S)$$ $$ \\ $$ $$ \text{Call Value} $$ $$ V_{f} = 7.85 $$ $$ \\ $$ $$ \text{Put value} $$ $$ V_{f} = 2.11 $$ b. What are the delta values of the call and put? $$ \Delta = \frac{\partial V}{\partial S} \approx \frac{V_{f} - V_{i}}{S_{f} - S_{i}}$$ $$ \Delta_{call} = 0.66 $$ $$ \Delta_{put} = -0.12 $$ c. How does an option's elasticity relate to its delta? $$ \lambda = \frac{\partial V}{\partial S} = \frac{\frac{\partial V}{V}}{\frac{\partial S}{S}} = \frac{S}{V} \times \Delta $$ $$ \lambda \text{ is the leverage} $$

6. Option trades are sometimes "tied to" a specific underlying price. That is, a customer may want to

trade an option and hedge it at an underlying prcie different than the current underlying price.

Consider this situation:

stock price = 73.50

time to expiration = 2 months

interest rate = 6.00%

dividend = 0

volatility = 25%

theoretical value of the 75 call = 2.64

delta of the 75 call = 48.00

gamma of the 75 call = 5.3

a. What will be the option's approximate delta and theoretical value if the underlying stock price rises to 75.00?

$$ \Delta_{f} = \Delta_{i} + \Delta S \times \Gamma_{i} $$

$$ TV_{f} = TV_{i} + \Delta S \times \overline{\Delta} $$

$$ \Delta_{f} = 55.95 $$

$$ TV_{f} = 3.42 $$

b. Using the delta and gamma, in general what should be the new value of an option if the price of the

underlying contract changes?

$$ TV_{f} = TV_{i} + \Delta S \times \overline{\Delta} $$

$$ \overline{\Delta} = \frac{\Delta_{f} +\Delta_{i}}{2} $$

$$ \Delta_{f} = \Delta_{i} + \Delta S \times \Gamma_{i} $$

$$ TV_{f} = TV_{i} + \Delta S \times (\frac{2 \times \Delta_{i} + \Delta S \times \Gamma}{2}) $$

c. Suppose a customer wants to buy a 75 call tied to an underlying price of 75.00. (Perhaps the customer wants the option

to be at-the-money.) If a market-maker takes the other side of this trade, what should be a fair price for the 75 call?

$$ TV_{f} = 3.42$$

7.

A. the price of the underlying stock rises

B. volatility rises

C. time passes

D. interest rate rises

E. the dividend is increased

If the underlying contract is stock, for the questions below fill in all appropriate choices from the above list:

a. Which of the above changes in market conditions will cause the delta of an at-the-money call to increase?

Answer: A - price increase causes delta to approach 1. D

b. Which of the above changes in market conditions will cause the delta of an out-of-the-money put to

increase (become more negative)?

Answer: B - Volatility rising will cause the out of the money put to approach -50. E because the stock will decrease in price more

causing a delta increase in magnitude for the put.

c. Which of the above changes in market conditions will cause the gamma of an at-the-money call to increase?

Answer: C - As time passes gamma gets very large.

d. Which of the avove changes in market conditions will cause the gamma of a deeply in-the-money put to increase?

Answer: A - As the price increases the curve shifts causing an increase in gamma. B because the volatility rise delta increases from -1 which

means that gamma increases as well. D interest rates rise.

e. Which of the above changes in market conditions will cause the theta of an at-the-money put to increase?

Answer: B - as volatility increases theta increases linearly. C because ATM theta values approach infinity as time passes.

f. Which of the above changes in market conditions will cause the vega of an out-of-the-money call to increase?

Answer: A - Yes, a price increase allows the out of the money call to be more likely to expire in the money. B because as implied volatility

increases so does vega. D interest rates rise.

8.

Futures price = 149.65

time to August expiration = 8 weeks

annual volatility = 24.20%

You have the following position:

-32 August 140 puts

+30 August 160 calls

-15 August futures contracts

with the options having these risk sensitivities:

\[

\begin{array}{|c|c|c|c|c|}

\hline

\text{Option} & \text{Delta} & \text{Gamma} & \text{Theta} & \text{Vega}\\

\hline

\text{August 140 put} & \text{-22.6} & \text{2.12} & \text{-0.0381} & \text{0.176}\\

\hline

\hline

\text{August 160 call} & \text{25.5} & \text{2.26} & \text{-0.0407} & \text{0.188}\\

\hline

\end{array}

\]

a. What is your total delta, gamma, theta, and vega position?

Answer:

\[

\begin{array}{|c|c|c|c|}

\hline

\text{Delta} & \text{Gamma} & \text{Theta} & \text{Vega}\\

\hline

\text{-11.8} & \text{-0.04} & \text{-0.0018} & \text{0.008}\\

\hline

\end{array}

\]

$$\text{Note: Sum up the deltas as both the options contracts are positive delta and the selling underlying is negative} $$

$$ \text{The underlying for gamma, theta, and vega are zero. Only the contracts are used for total values.} $$

b. Considering only the delta, gamma, theta, and vega, how risky do you think this position is?

Answer: The position does not look to risky as all the greeks are near zero or just about neutral. Meaning contract value does not change

with movement of the underlying.

c. Is your conclusion in question b reasonable?

Answer: Seems reasonable at the moment, but market conditions change and these parameters will change as well.

d. What will happen to your delta, gamma, and vega position (become positive or less negative, become more negative

or less positive, stay about the same) if the futures price rises while all other market conditions remain unchanged?

Answer: Delta will be positive, gamma will be positive, theta will be positive, and vega will be positive.

e. What will happen to your delta, gamma, and vega position (become positive or less negative, become more negative

or less positive, stay about the same) if the futures price falls while all other market conditions remain unchanged?

Answer: Delta will be more positive, gamma more negative, and vega more negative.

f. What will happen to your delta position (become positive or less negative, become negative or less positive,

stay about the same) if volatility increases to 28% while all other market conditions remain unchanged?

Answer: Delta will be more positive.

g. What will happen to your delta position (become positive or less negative, become negative or less positive,

stay about the same) if three weeks pass while all other market conditions remain unchanged?

Answer: Delta will be more negative.

h. Suppose the futures contract makes a very large downward move. What is your maximum downside delta?

Answer: On a very large movement downward the 160 call delta goes to 0. The 140 put goes to +100 because we sold.

$$ \Delta_{downside} = \Delta_{put sold} + \Delta_{call buy} + \Delta_{underlying} = 32 \times 100 - 1500 = +1700 $$

i. Suppose the futures contract makes a very large upward move. What is your maximum upside delta?

Answer: On a very large movement upward the 140 put delta goes to 0.

$$ \Delta_{upside} = \Delta_{put sold} + \Delta_{call buy} + \Delta_{underlying} = 30 \times 100 - 1500 = +1500 $$

j. Rank the order in which the following combination of market conditions will most help or hurt

your position (1 = helps the most; 4 = hurts the most).

Answer:

1. the futures price rises quickly to 160 and implied volatility rises to 26.20%

2. the futures price falls slowly to 140 and implied volatility falls to 22.20%

3. the futures price rises slowly to 160 and implied volatility falls to 22.20%

4. the futures price falls quickly to 140 and implied volatility rises to 26.20%